Nigeria / Shell relationship as the nation gets most advantage, payout increase

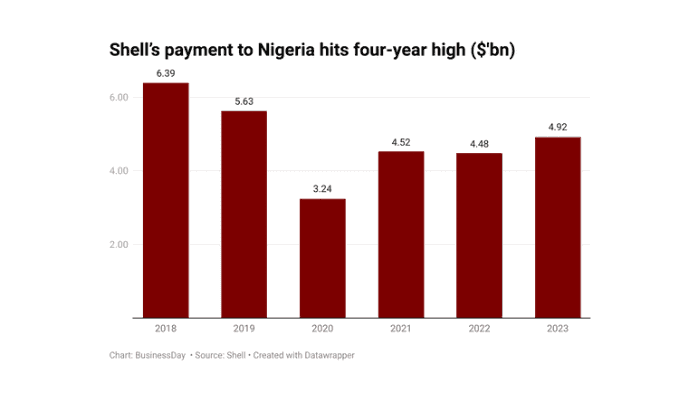

Nigeria has regained its position as the biggest recipient of payments from Shell as production entitlement, royalties, taxes and fees to the government in 2023 amounted to $4.92 billion, the highest in four years.

The payout to Nigeria increased by 8.85 percent compared to the previous year, representing 16.67 percent of the company’s total payments to 26 countries, new data released by Shell shows.

Africa’s largest oil producer lost the top position in 2021, when Norway received the largest amount of about $4.52 billion compared to the $4.48 billion paid to the West African country.

In 2022, Nigeria dropped further to the third-biggest recipient of payments from the British oil giant, although the amount paid to it rose by 0.92 percent to $4.52 billion. The company’s payment to the country hit a high of $6.39 billion in 2018 but fell to $5.63 billion in 2019 and $3.24 billion in 2020.

Shell’s payments to countries where it has operations declined 14.11 percent year-on-year to $29.52 billion last year as its annual profit dropped 30 percent compared to its highest-ever earnings of $39.9 billion notched in 2022.

It said in its latest report that payments made to governments arose “from activities involving the exploration, prospection, discovery, development and extraction of minerals, oil and natural gas deposits or other materials (extractive activities)”.

Its subsidiaries in Nigeria paid $3.46 billion to the Nigerian National Petroleum Company (NNPC) last year as production entitlement, while $587.64 million was paid in taxes to the Federal Inland Revenue Service.

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) was paid about $727.85 million and $1.73 million for royalties and fees respectively, while $139.99 million was remitted to the Niger Delta Development Commission.

Shell paid fees amounting to $4.28 million and $85,890 to the National Agency for Science and Engineering Infrastructure and Nigeria Police Trust Fund respectively.

Shell’s payments to the Nigerian governments look set to drop this year following its decision to sell its onshore business in the country.

The company announced on January 16 that it had agreed to sell its Nigerian onshore subsidiary, Shell Petroleum Development Company of Nigeria Limited (SPDC), to Renaissance, a consortium of five companies consisting of ND Western, Aradel Energy, First E&P, Waltersmith and Petrolin.

“This is an important step for the company and we hope to complete the deal as soon as possible,” Wael Sawan, chief executive officer of Shell, said last month during his presentation of the company’s 2023 fourth-quarter and full-year results.

International oil companies operating in the country have had to sell many of their onshore assets since 2010, when divestment saw Seplat Energy Plc and other local operators snapping up oil blocks.

ExxonMobil announced in February last year that it had agreed to sell to Seplat its equity interest in Mobil Producing Nigeria Unlimited, which holds a 40 percent stake in four oil mining licences including more than 90 shallow-water and onshore platforms and 300 producing wells. But the transaction has been blocked by the regulator and the NNPC.

Operators in the sector have been plagued by oil theft and pipeline vandalism for years, with the country’s production falling below 1 million barrels per day in 2022 as against a peak of 2.5 million bpd in 2010. Last year, the crude oil output ranged from 1 million bpd to 1.35 million bpd, according to data from the NUPRC.

In its 2023 Sustainability Report released on Tuesday, Shell said 139 of the 140 spills it recorded as a result of sabotage last year happened in Nigeria, with the volume of spills increasing to 1,400 tonnes from 600 tonnes in 2022.

“Most oil spills in the Niger Delta continue to be caused by crude oil theft, the sabotage of oil and gas production facilities, and illegal oil refining, including the distribution of illegally refined products,” it said.

It said that in 2023, SPDC continued on-ground surveillance of its areas of operation, including its pipeline network, to mitigate third-party interference and ensure that spills are detected and responded to as quickly as possible.

“There are daily surveillance flights over the most vulnerable segments of the pipeline network to identify any new spills or illegal activity. SPDC has introduced anti-theft protection mechanisms for key infrastructure, including steel cages to protect wellheads,” it said.

In 2023, 60 new steel cages were installed around critical infrastructure nodes, bringing the total number of cages installed to 374, according to the report.

“This includes 52 cages that have been upgraded with CCTV and 28 with satellite communications,” Shell said. “In 2023, out of 508 registered attempts to breach the cages, 38 were successful.”