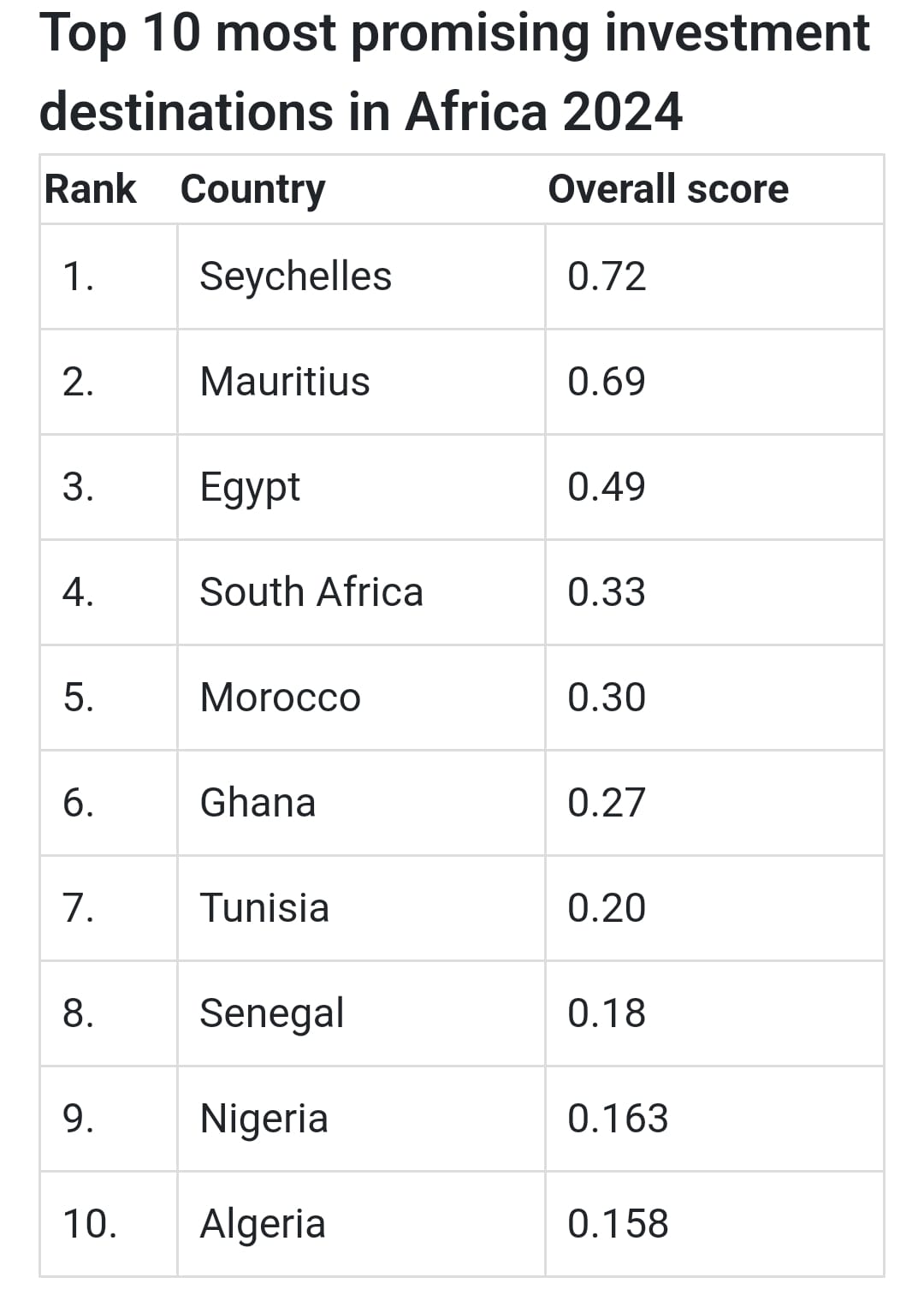

Nigeria among the Top 10 most promising investment destinations

Nigeria ranks No 9 among top ten in Africa.

… this is reflective of numerous African countries in recent years, which have over time, developed conducive environment for both local and foreign investments.

There are significant ramifications for not only countries but Africa as a whole when African countries becomes prime locations for investments. Its economy, governance, and global integration are maturing, and this development is suggestive of other important aspects that indicate this. Via indicators such as GDP, population, urbanization, these countries boast very positive economic prospects.

Markets with a steady and favorable return on investment (ROI) attract investors. A nation sends out signals to international investors that it is a good location to invest when it exhibits steady GDP growth, low rates of inflation, and a stable currency.

This in turn draws additional foreign direct investment (FDI), which feeds economic growth even more, producing a positive feedback loop of wealth and expansion.

Fortunately, this is reflective of numerous African countries in recent years, which have over time, developed a conducive environment for both local and foreign investments.

Said African countries have spent time and resources, ensuring that they are highly competitive on the global stage, when it comes to ROIs.

With some of the world’s finest infrastructure, technology, security, political climate, and hospitality, these African countries have become a safe haven for foreign businesses looking to expand their influence.

The 54 countries that make up the complex and diverse continent of Africa differ in terms of their social and human development, market accessibility and innovation, economic stability and investment climate, and economic performance and potential, all of which have been shown to influence a nation’s advancement and, consequently, its potential for investment.

The “Where to Invest in Africa in 2024” report by the Corporate and Investment Banking Rand Merhcant Bank(RMB), highlights 31 of these African countries and their investment potentials or as they put it, investability.

The report highlights and scores these countries based on 20 metrics, including, GDP, population, urbanization, inflation and more, which were converted to a mean weighted score called the Z-score. See methodology and Z-score below…

With that said, here are the top 10 African countries for investment.

This list is courtesy of the Corporate and Investment Bank RMB.

RMB utilized these 20 metrics to compute the overall score: GDP, GDP per Capita, Growth Structure, GDP Growth Forecast, Population Size, Population Growth, Urbanisation, Economic Complexity, Connectedness, Innovation, Import Concentration, Forex Stability & Liquidity, Economic Freedom, Inflation, Corruption, Political Stability, Human Development, Income, Inequality, Personal Freedom, Unemployment.

Data for each metric is drawn from multiple sources, each using its own method for calculation and scoring. For example, RMB drew GDP numbers from the World Bank, which calculates these as nominal figures in current US dollars, while the bank also drew the Human Development score from the Human Development Index, which rates and ranks countries by using inputs ranging from life expectancy at birth to mean years of schooling.

In order to standardize the data, so that each metric and score can be compared like for like, RMB converted all source scoring into Z-scores. The bank calculated a mean for each metric’s data.